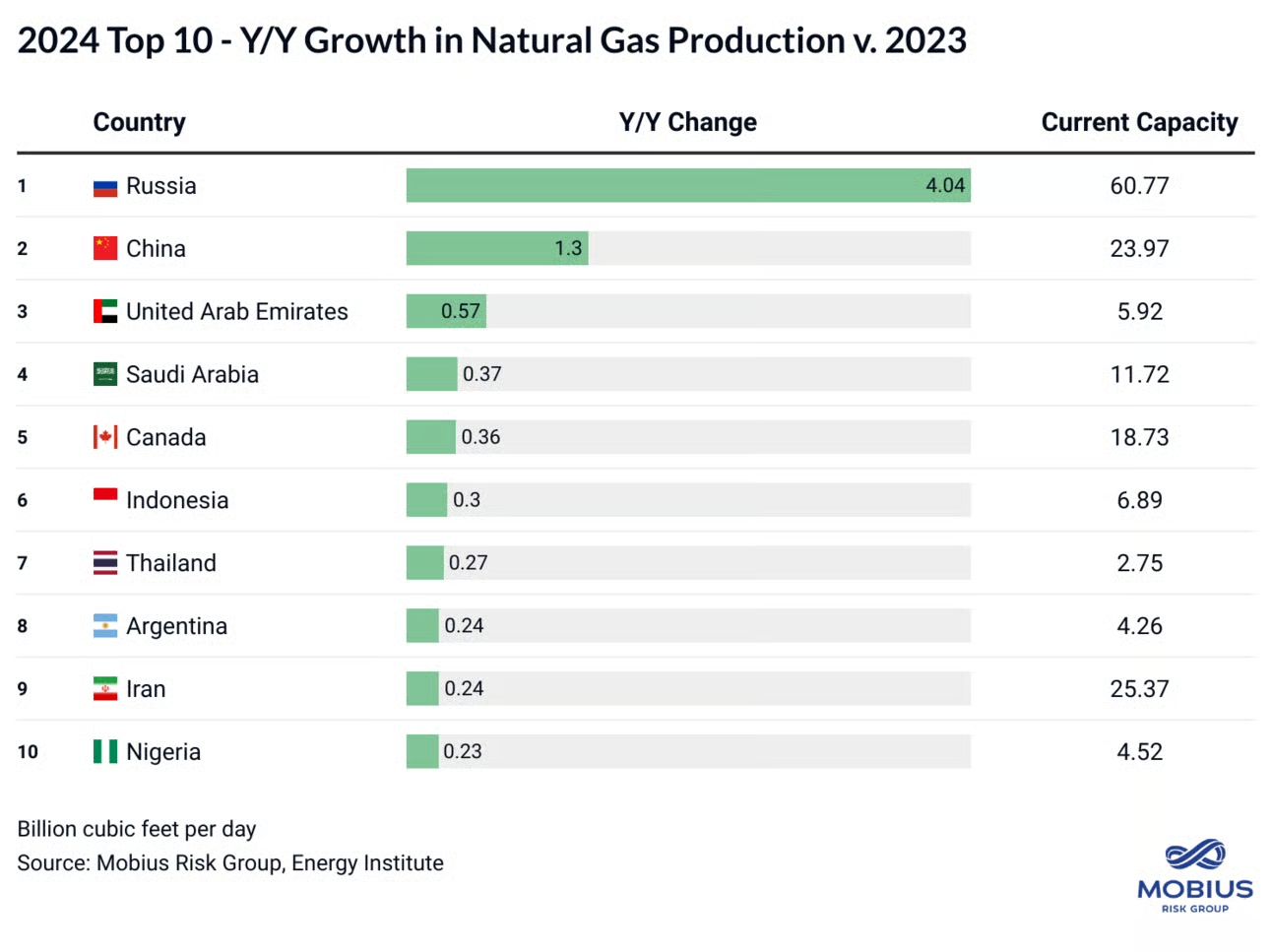

2024 Top 10: Global Natural Gas Supply & Demand Growth

Russia jumped to #1 spot for year-over-year production growth at +4.04 Bcf/d, while China maintained #2 position with +1.3 Bcf/d in 2024. India's LNG imports increased 25% to 3.66 Bcf/d in 2024, claiming the #1 fastest-growing importer position.

Read Full Analysis: ES #146: The World's Ten Fastest-Growing Gas Producers & Consumers

Catch up on the market

Compensation Pledges Absent From OPEC8+ Production Data

OPEC8+ production gained 394 kb/d month-over-month in June, with Kazakhstan leading overproduction at +479 kb/d versus pledged compensation. Iran's crude exports to China jumped >700 kb/d in June to its second-highest level of 2025, while Iranian production declined for the second consecutive month.

Read Full Analysis: Brief: OPEC+, Iran, & China

Hedge Funds Target Low Distillate Stocks

Fund managers established top-quartile net length in ICE gasoil and NYMEX heating oil futures and options in response to dwindling global distillate inventories. Meanwhile, speculative net length in gasoline has held at historically low levels from persistent top-decile short interest. Fund positioning in major crude benchmarks diverged as uncertainty pushes more speculators to the sidelines.

Read Full Analysis: CoT: Hedge Funds Target Low Distillate Stocks

U.S. Production Falls While LNG Nominations Surge

Domestic fundamentals improved in early July as production slowed moderately and total U.S. LNG feed gas nominations surged to multi-month highs and over 5 Bcf/d above levels from the same period last year.

Read Full Analysis: Daily Market Update - July 15, 2025

Connect with Mobius

Navigate Market Volatility with Confidence

Identify portfolio-specific opportunities, develop tailored strategies, and stress-test your bottom line with real-time scenario analysis on RiskNet—the leading risk management platform for global commodity markets.

© 2025 Mobius Risk Group, LLC. All rights reserved.